Pandemic transforming the art market – benefitting artists and buyers

“Corona facilitates what was long overdue: It enforces the transformation of the art world and helps to democratise the art market by opening it up to the public. Digital access to art enforces transparent prices and enables everybody to buy great art at a fair price. That makes the art market accessible for everyone.“ – One of our #expertstatements from Dr. Ruth Polleit-Riechert.

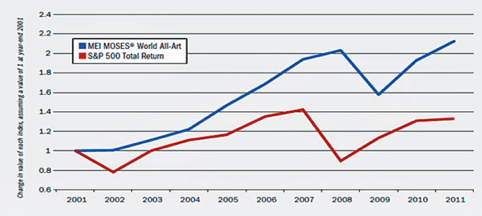

The “lockdown” in the wake of the Coronavirus pandemic has far-reaching implications. Its consequences also affect the international art market. It is threatened by a colossal collapse. It is no longer a question of if lightning strikes, but when. In past recession phases, the crash on the art market usually followed with a time lag, but it always came. One recalls how sales and prices crashed at the end of 1989/beginning of 1990 when the speculation bubble burst in Japan, or when the financial and economic crisis took hold worldwide in 2008/2009.

Museums, auction houses, trade fairs, and galleries have cancelled many events because of the Corona pandemic. The art market is, therefore, facing a shakeout. Only those players will survive who have built up online sales platforms early on. Those who have stubbornly resisted new technologies and market transparency will fail.

An underdeveloped market

The art market is international, and it has certain peculiarities. Firstly, it is a comparatively small niche market. In 2019, the turnover was only an estimated 64 billion US dollars. By way of comparison, turnover on the German stock market is currently around 170 billion euros – per month.

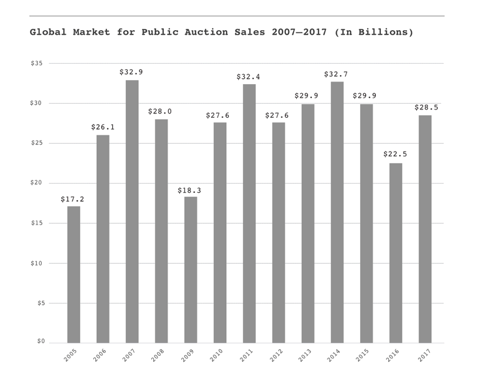

On the other hand, the international art market is only growing at low rates: From 2008 to 2018, the increase in turnover was only about 9 per cent – while in this period, economic output in the USA increased by 48 per cent and the assets of so-called “high net-worth individuals” more than doubled.

Lack of price transparency

How can the underperformance of the international art market be explained? It is not due to a lack of interest in art. Even if only a few people buy art, many are interested in art, enjoy it, want to surround themselves with it. The statistics show this: in recent years, the number of art fairs has increased significantly, and the number of visitors to museums has remained stable at a high level. So what is it that keeps people from buying a work of art?

The most important reason is the lack of price and quality transparency. Markets that can develop freely are usually transparent. One example is the stock market. On it, all participants can see the price formation of the shares bought and sold, especially since the players are prohibited from using insider information for their own purposes or spreading false news.

Compared to the stock market, the art market performs poorly. The amount of information available to an art lover is low compared to the total information. Here are a few examples: For one, it is not apparent to outside parties which artists are entering the art market with which works of art. Nor is it clear who determines which artists are allowed to show which works in galleries, exhibitions, fairs, and museums. Above all, many art lovers do not know how the prices for works of art are formed.

Who benefits from the lack of price transparency?

So while art lovers poke around in the dark, others profit from the opacity of the market. These are the big players: famous galleries and museums, especially those in New York. They give thumbs up or down – and thus decide what is good and what is bad art. In doing so, they also decide which artists have a career and which don’t; which price for the artworks is the “right” one and how this price develops over time. This assumption is confirmed by a study by art market economist Magnus Resch.

But why are these institutions so influential? Well, gallery owners and museums have been cooperating for decades, building power in the process. Galleries have supported museums through financial or artistic contributions. Museums, in turn, have exhibited the gallery’s artists, increased their visibility and thus raised their market value. In addition, selected critics and art magazines, with their reviews and recommendations, have given art a detached, elitist, exclusive image with the public. All this attracts a clientele of billionaires with tremendous purchasing power. The gallery owners have benefited from this in turn – a perfect symbiosis.

The art of transfiguration of art and a handful of selected artists have given a few gallery owners a unique market position. Andy Warhol (1922-1987) said it perfectly: “Being good in business is the most fascinating kind of art. Making money is art and working is art, and good business is the best art.“ Thanks to their powerful position, the influential museums, gallery owners and experts were largely able to fend off newcomers on the market. New technology-based start-ups, which could provide more transparency, often lack access to the most sought-after works of art and artists represented by the opinion-leading galleries. The oligopolisation of the art market has fostered a lack of transparency in price formation and damaged the consumers’ position.

If art lovers cannot understand the price of a painting, for example, they must fear being ripped off. Then they will refrain from buying. This explains why sales and growth in the art market have been so weak in recent years.

A new art world is developing

The “lockdown” is now turning everything upside down – and transforming the art market. Now the events that are part of the lifestyle of the most important art buyer clientele, whose willingness to pay high prices has kept the art market going, are missing. Because social distancing is the order of the day, the art market must open itself up to digitalisation. The Internet is replacing the vernissage. New marketing technologies and new distribution channels will have to take hold, and old structures will be broken up. This will erode the power of renowned museums and galleries – to the advantage of art lovers, artists, and dealers, opening up new marketing opportunities for artists. Instead of bringing their works of art to the public through the eye of the (gallery) needle, they can market their works themselves on the Internet. This allows them to get in direct contact with potential buyers and initiate transactions themselves.

The lockdown makes the art market more transparent; the interpretative sovereignty of the previous opinion leaders is built on sand now. If information about artists, their works, the prices achieved for their works of art become publicly accessible via the Internet, it should encourage new art lovers to enter the art market. The prices are no longer determined by the dictates of the few, but by the appreciation of the many.

There is no doubt that the creation of a transparent, differentiated international art market, in which the artists, their work, and the buyers are the focus of attention, would be splendid. For art as the “mediator of the unspeakable” (Johann Wolfgang von Goethe) mediates between people, brings them together, creates commonalities and bonds. The “lockdown” now opens the chance to raise this great potential through more transparency in the market for art.

Über 20blue

Das Research Institute 20blue bringt Sie weiter! Wir sorgen seit 2011 mit wissenschaftlichen Insights und Methoden für den nötigen Durchblick. Unser Research Institute sichert Entscheidungen ab - dank 300 Expert*innen aus vielen Disziplinen, Branchen und Ländern. Ebenso vielfältig: unsere Kunden aus Wirtschaft und Politik. Im interdisziplinären Zusammenspiel entsteht neues Wissen auf dem Weg zur nachhaltigen Transformation.

Mehr erfahrenSie müssen den Inhalt von reCAPTCHA laden, um das Formular abzuschicken. Bitte beachten Sie, dass dabei Daten mit Drittanbietern ausgetauscht werden.

Mehr Informationen